“Prices are going up and everyone wants someone to blame.”

After much back and forth in 2021, the narrative on inflation in the United States has solidified: rather than being transitory as so many had hoped, rising prices are persistent and becoming increasingly problematic for the U.S. economy. It’s no secret that inflation (as measured by the Consumer Price Index) hit a 40-year high in January, and is likely to continue higher as the Russian invasion of Ukraine wreaks havoc on global commodity prices. The continued rise in inflation appears even more problematic because up until now wage increases haven’t kept up. In fact, inflation outpaced wage growth by 1.7% in 2021.

This naturally spawns a blame game over who’s responsible for this drop in “real” wages. In this day and age, it’s inevitable that someone will point the figure at the business community and larger businesses in particular. Given the firestorm around inflation and real wage growth, it’s easy to lose sight of the massive hiring spree that businesses went on in 2021 and the wage increases that came with it.

In the coming months, there is an opportunity to correct that narrative. When we look at the root causes of inflation, we see a number of different factors working together, including supply chain disruptions, unusually high levels of fiscal stimulus, and unnaturally high consumer demand coming out of the pandemic.

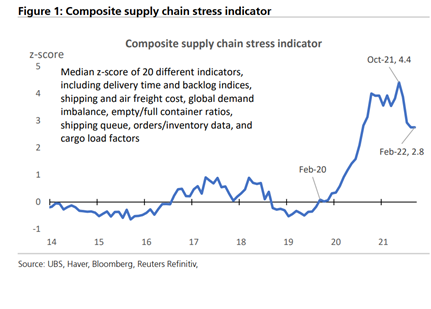

Businesses have devoted time and energy to addressing supply chain disruptions and there are signs that it’s working:

What’s more, the geopolitical calamity in Ukraine has completely rewritten the inflation narrative. Russian aggression has triggered an international response from companies eager to use their brands to exert financial and political pressures. The decision to stop doing business in Russia, to stop taking Russian oil and gas, to cut Russia off from the global financial system, these are actions that companies are swiftly and aggressively putting into place despite the loss of product and profit associated with them. The extreme inflation we now see in energy and commodities will likely slow consumer demand in Europe and the U.S., potentially creating a stagflationary environment companies must further account for. Right now, Americans feel it most acutely at the pump. Gas prices are up 10% this week and are now higher than they’ve ever been before. And yet, 71% of Americans are accepting of higher gas prices if it means banning Russian oil imports.

Longer term, this increase in raw materials has the potential to raise prices on finished goods and services. Companies will continue to let those price hikes eat into profits and stagflation will further hurt their bottom lines. From a narrative perspective, this is where we see base effects kick in. “Base effects” is the term used to explain the importance of the denominator in any year-over-year calculation, like CPI’s 7.5% increase in January of 2022. When the previous year sets a particularly low or high denominator in a year-over-year calculation, those “base effects” impact how low or high the increase appears to be.

Inflation started rising sharply in March and April of 2021. That means the base effects on the year-over-year calculation in CPI would kick in around March or April of 2022 and will persist throughout much of 2022. Prior to the invasion of Ukraine, there was reason to believe inflation would actually slow in 2022, and that is still likely later in the year if Russia pulls back and commodities adjust accordingly. But because of base effects, the appearance of inflation via the top line CPI numbers will also slow. This won’t happen as soon as we’d like but inflationary pressures in energy and food are historically cyclical and therefore less “sticky” than other price hikes.

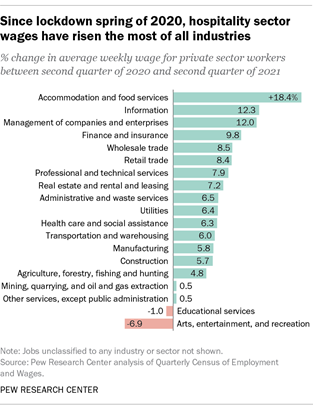

This poses a potentially meaningful juxtaposition with wages. It’s already true that many sectors did in fact experience real wage growth in 2021:

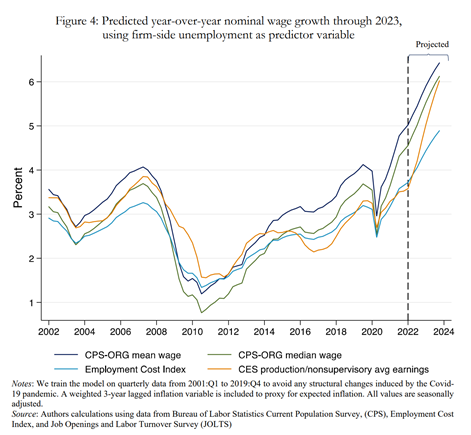

The labor market remains tight and wage growth is likely to persist in 2022 and beyond:

Wage growth creates upwards inflationary pressure, and is thought of as sticky, because wage increases are usually permanent (though the flurry of signing bonuses currently proliferating the hiring market are unlikely to last forever). Nevertheless, wage growth is good for the American worker and companies can take advantage of the goodwill that comes from paying employees more. The page has already started to turn on real wages in 2022: wage growth outpaced inflation in both December of 2021 and January of 2022, but that story was lost to the alarming top line year-over-year inflation numbers and the humanitarian crisis in Ukraine. What’s more, wage growth didn’t begin in earnest in 2021 until the second half of the year. There may be several months in the first half of 2022 (again thanks to base effects) when real wages keep pace or even outpace inflation at both one-month and 12-month intervals.

For much of 2021, businesses were an easy scapegoat for inflation. But there are other inputs we will be talking about throughout this year and into the next. As soon as pandemic-related inflation appeared ready to slow down, geopolitical inflation exploded. Through it all, wages continue to rise as base effects start to kick in.